Multiple Choice

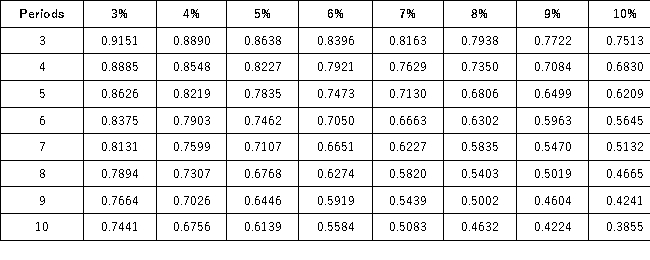

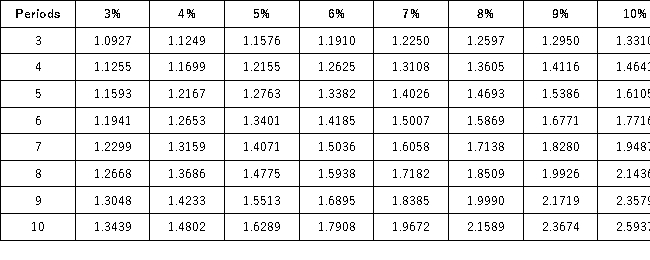

Present Value of 1  Future Value of 1

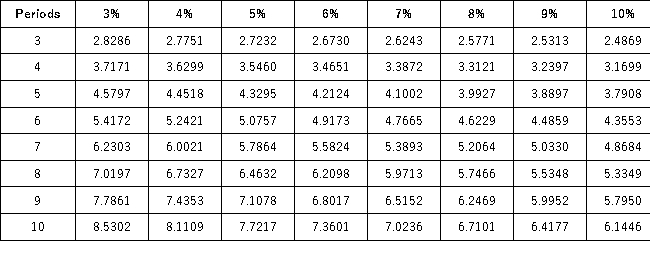

Future Value of 1  Present Value of an Annuity of 1

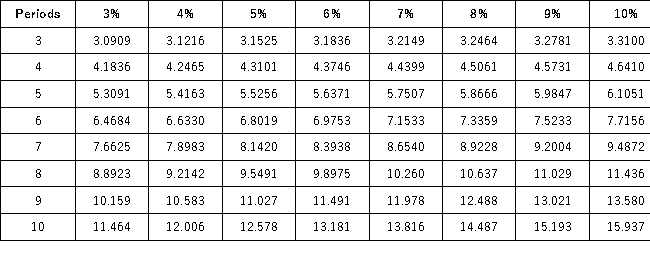

Present Value of an Annuity of 1  Future Value of an Annuity of 1

Future Value of an Annuity of 1  The Masterson family is setting up a vacation fund,and they plan on depositing $1,000 per quarter in an investment that will pay 12% annual interest.What amount will they have available for their vacation at the end of 2 years?

The Masterson family is setting up a vacation fund,and they plan on depositing $1,000 per quarter in an investment that will pay 12% annual interest.What amount will they have available for their vacation at the end of 2 years?

A) $8,000.00

B) $8,960.00

C) $8,892.30

D) $8,240.00

E) $8,487.20

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q4: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q5: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q6: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q7: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q9: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q10: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q11: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q12: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present

Q13: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2412/.jpg" alt="Present