Essay

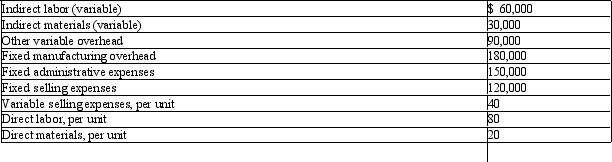

Baker Company produced 30,000 units and sold 28,000 units in 2011.Beginning inventory was zero.During the period,the following costs were incurred:

Required: Compute the dollar amount of ending inventory using:

Required: Compute the dollar amount of ending inventory using:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q15: Inventory under absorption costing includes only direct

Q24: Laird Company uses 405 units of a

Q26: Figure 8-7. Ramon Company reported the following

Q28: Figure 8-5. Sanders Company has the following

Q30: Figure 8-1. Last year,Fabre Company produced 20,000

Q34: The _ income statement groups expenses according

Q34: Simon Company sells 900 units of its

Q95: Total inventory-related cost consists of ordering cost

Q98: On a segmented income statement, fixed costs

Q155: Gross margin is to absorption costing as