Essay

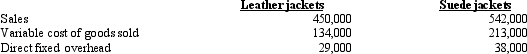

Prepare a segmented income statement for Mario Co.for the coming year,using variable costing.

A sales commission of 2% of sales is paid for each of the two product lines.Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets.Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

A sales commission of 2% of sales is paid for each of the two product lines.Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets.Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

Required: Prepare a segmented income statement for Mario Co.for the coming year,using variable costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The inventory cost that can include insurance,

Q53: A major drawback to the JIT inventory

Q77: Carter Company orders 250 units at a

Q78: You decide<br>You have just become the controller

Q81: Figure 8-6. Bailey Company incurred the following

Q84: Figure 8-1. Last year,Fabre Company produced 20,000

Q86: Figure 8-5. Sanders Company has the following

Q87: Ellie Manufacturing Company produces three products: A,B,and<br>C.The

Q117: When production is less than sales volume,

Q174: The _ income statement groups expenses according