Multiple Choice

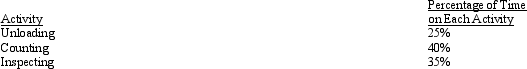

Figure 7-1. The receiving department of Owen has three activities: unloading,counting goods,and inspecting.Unloading requires a forklift that is leased for $15,000 per year.The forklift is used only for unloading.The fuel for the forklift is $2,000 per year.Inspection requires special testing equipment that has a depreciation of $500 per year and an operating cost of $1,000 per year.Receiving has four employees who each have an average salary of $35,000 per year.The work distribution matrix for the receiving personnel is as follows: Refer to Figure 7-1.Calculate the cost of unloading.

Refer to Figure 7-1.Calculate the cost of unloading.

A) $50,500

B) $56,000

C) $52,000

D) $54,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following is not a

Q19: The time required to produce one unit

Q73: Assume that the accounts payable department of

Q73: The cost of recalls would be an

Q74: Figure 7-3. Hamilton Company manufactures engines.Hamilton produces

Q75: Figure 7-5. Rizzo Manufacturing produces two types

Q77: Figure 7-2. Steller Manufacturing has two classes

Q80: _ activities are unnecessary activities.<br>A)Frivolous<br>B)Nonvalue-added<br>C)Expensive<br>D)Under-performing<br>E)none of these

Q83: Environmental costs are costs that are incurred

Q144: Costs incurred when products and services prior