Multiple Choice

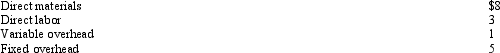

Piersall Company makes a variety of paper products.One product is 20 lb copier paper,packaged 5,000 sheets to a box.One box normally sells for $18.A large bank offered to purchase 3,000 boxes at $14 per box.Costs per box are as follows:  No variable marketing costs would be incurred on the order.The company is operating significantly below the maximum productive capacity.No fixed costs are avoidable.

No variable marketing costs would be incurred on the order.The company is operating significantly below the maximum productive capacity.No fixed costs are avoidable.

Should Piersall accept the order?

A) Yes,income will increase by $6,000

B) Yes,income will increase by $9,000

C) No,income will decrease by $3,000

D) No,income will decrease by $6,000

E) It doesn't matter; there will be no impact on income

Correct Answer:

Verified

Correct Answer:

Verified

Q37: In deciding the optimal mix of products

Q55: Irrelevant costs are costs that are the

Q63: Future costs that differ across alternatives are

Q71: Stadium Company charges cost plus 60%.If the

Q72: Limited resources or a limited demand for

Q103: In short-run decision making, the alternative with

Q110: Victor's Detailing customers would be willing to

Q147: Figure 13-6. Autry Company manufactures veterinary products.One

Q148: Foster Industries manufactures 20,000 components per year.The

Q150: Veblen Company manufactures a variety of athletic