Multiple Choice

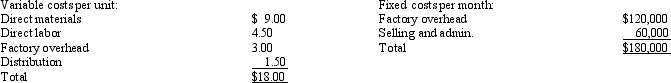

Miller Company produces speakers for home stereo units.The speakers are sold to retail stores for $30.Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores.The current production and sales volume is 20,000 per year.Capacity is 25,000 units per year.

A Tennessee manufacturing firm has offered a one-year contract to supply speakers at a cost of $17.00 per unit.If Miller Company accepts the offer,it will be able to rent unused space to an outside firm for $18,000 per year.All other information remains the same as the original data.What is the effect on profits if Miller Company buys from the Tennessee firm?

A) decrease of $8,000

B) increase of $9,000

C) increase of $8,000

D) decrease of $6,000

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Victor's Detailing customers would be willing to

Q20: The following information pertains to Dodge Company's

Q21: The following information relates to a product

Q23: Figure 13-5. Santorino Company produces two models

Q26: Classy Carry manufactures two types of handbags,the

Q28: Sherrell Washington owns a successful hole-in-the-wall bagel

Q29: Figure 13-4. Connolly Company produces two types

Q44: Shear-it, Inc., produces paper shredders.Shear-it is considering

Q46: A situation in which management tells divisions

Q70: Which of the following is not a