Essay

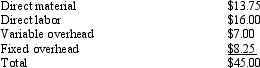

Tapeo Company has always made its electronic components that go into their GPS systems in-house.Streeter Company has offered to supply these electronic components at a price of $38 each.Tapeo uses 18,000 units of these components each year.The cost per unit of this component is as follows:

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Required:

A.If Tapeo decided to purchase the electronic component from Streeter Company how much would its operating income increase or decrease?

B.Should Tapeo continue to make the electronic component or buy it from Streeter Company?

Correct Answer:

Verified

A.  B.Tape...

B.Tape...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: A choice between internal and external production

Q13: The markup includes desired profit and any

Q74: Figure 13-1. Fuller Company makes frames.A customer

Q75: Figure 13-2. ColorPro uses part 87A in

Q79: Target costing is a method of determining

Q79: A decision that involves potential further processing

Q80: Vest Industries manufactures 40,000 components per year.The

Q116: Linear programming is a special technique that

Q124: The difference between the summed costs of

Q147: In keep-or-drop decisions, both the segment's contribution