Multiple Choice

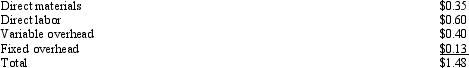

Figure 12-3. Grey Inc.has many divisions that are evaluated on the basis of ROI.One division,Centra,makes boxes.A second division,Mantra,makes chocolates and needs 80,000 boxes per year.Centra incurs the following costs for one box: Centra has capacity to make 700,000 boxes per year.Mantra currently buys its boxes from an outside supplier for $1.80 each (the same price that Centra receives) .

Centra has capacity to make 700,000 boxes per year.Mantra currently buys its boxes from an outside supplier for $1.80 each (the same price that Centra receives) .

Refer to Figure 12-3.Assume that Grey Inc.mandates that any transfers take place at full manufacturing cost.What would be the transfer price if Centra transferred boxes to Mantra?

A) $1.35

B) $1.48

C) $1.00

D) cannot be determined from the information given

E) $0.90

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The strategic management system that translates an

Q42: In calculating residual income, the minimum rate

Q65: A _ is the price charged for

Q80: Decentralization is usually achieved by creating units

Q93: Given the following information for the Reardon

Q96: The Dear Division of Zimmer Company sells

Q101: If the margin of 0.3 stayed the

Q103: Figure 12-5. The following information pertains to

Q116: _ is after-tax operating income minus the

Q130: The number of units of output that