Multiple Choice

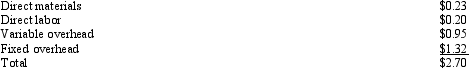

Figure 12-4. Quinn Inc.has a number of divisions.One division,Style,makes zippers that are used in the manufacture of boots.Another division,LeatherStuff,makes boots that use the zippers and needs 90,000 zippers per year.Style incurs the following costs for one zipper: Quinn has capacity to make 950,000 zippers per year,but due to a soft market,only plans to produce and sell 620,000 zippers next year.LeatherStuff currently buys zippers from an outside supplier for $3.50 each (the same price that Style receives) .

Quinn has capacity to make 950,000 zippers per year,but due to a soft market,only plans to produce and sell 620,000 zippers next year.LeatherStuff currently buys zippers from an outside supplier for $3.50 each (the same price that Style receives) .

Refer to Figure 12-4.Assume that Style and LeatherStuff have agreed on a transfer price of $3.25.What is the total benefit for Style?

A) $243,000

B) $292,500

C) $118,800

D) $69,000

E) $81,000

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A responsibility center in which a manager

Q15: The Balanced Scorecard perspective that describes the

Q16: Using Economic Value Added (EVA) to calculate

Q18: If the selling division is operating at

Q20: Chase Company had the following income statement

Q35: _ emphasizes only effectiveness of implementation.

Q55: _ is the difference between realization and

Q93: If there is a competitive outside market

Q112: A production department within the factory, such

Q153: The practice of delegating decision-making authority to