During the Year,Garbin Corporation (A Calendar-Year Corporation That Manufactures Furniture)purchased

Multiple Choice

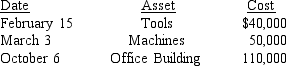

During the year,Garbin Corporation (a calendar-year corporation that manufactures furniture) purchased the following assets:  In computing depreciation of these assets,which of the following averaging conventions will be used?

In computing depreciation of these assets,which of the following averaging conventions will be used?

A) Half-year and mid-month

B) Mid-quarter and mid-month

C) Half-year,mid-quarter,and mid-month

D) Mid-quarter only

Correct Answer:

Verified

Correct Answer:

Verified

Q17: The adjusted basis of an asset is:<br>A)Its

Q26: Jack did not depreciate one of his

Q33: Barber Corporation purchased all the assets of

Q33: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q37: Conrad Corporation has a June 30 year

Q38: On October 2,2013,Andres Corporation (a calendar year

Q39: _ 7.The MACRS life for all realty

Q40: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q41: _ 4.The basis in property acquired by

Q71: Joe started a new business this year.He