Essay

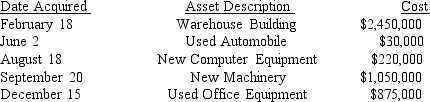

Table 1: Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2013:

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

-Refer to the information in Table 1.What is Sanjuro Corporation's maximum total cost recovery deduction for 2013?

a.$512,550

b.$1,193,830

c.$1,731,707

d.$2,175,000

Correct Answer:

Verified

The total cost recovery for al...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: The only acceptable convention for MACRS realty

Q38: On October 2,2013,Andres Corporation (a calendar year

Q39: _ 7.The MACRS life for all realty

Q40: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q41: _ 4.The basis in property acquired by

Q44: _ 17.The lease inclusion amount in the

Q46: _ 1.The costs of all assets with

Q48: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q52: The after-tax cost of an asset<br>A)Is higher

Q63: The first and last years of MACRS