Multiple Choice

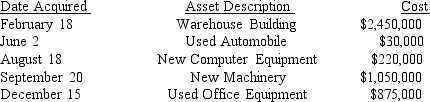

Table 1: Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2013:

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

-Refer to the information in Table 1.What is Sanjuro Corporation's cost recovery deduction for the office equipment for 2014 assuming the necessary elections were made to maximize overall depreciation in 2013?

A) $134,695

B) $78,595

C) $31,680

D) 0

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The only acceptable convention for MACRS realty

Q38: Bangor Company incurred $70,000 of research costs

Q44: _ 17.The lease inclusion amount in the

Q46: _ 1.The costs of all assets with

Q48: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q50: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q51: _ 6.The mid-year and mid-month are acceptable

Q52: The after-tax cost of an asset<br>A)Is higher

Q52: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q53: _ 13.Bonus depreciation and Section 179 expensing