Essay

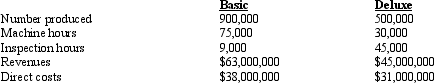

Office Innovations Corporation produces two types of electronic data organizers: basic and deluxe.The following information about the production process is available:

Total factory overhead is $10,000,000.Of this overhead,$4,000,000 is related to utilities and the remainder is related to quality control.

Total factory overhead is $10,000,000.Of this overhead,$4,000,000 is related to utilities and the remainder is related to quality control.

a.Determine the total overhead cost assigned to each type of data organizer using machine hours as the allocation base.Calculate the gross profit per unit for each product.

b.Determine the total overhead cost assigned to each type of data organizer if overhead is assigned using allocation bases appropriate to the overhead costs.Calculate the gross profit per unit of each product.

c.Explain why the unit cost for each model is different between the two methods of allocation.

Correct Answer:

Verified

c)When machine hours are used to alloca...

c)When machine hours are used to alloca...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: For a company that manufactures candy,how would

Q23: Ada National Bank Ada National Bank had

Q24: Ada National Bank Ada National Bank had

Q27: Seattle Grace Corporation manufactures two models of

Q30: Levine Company Levine Company produces two products:

Q41: For one product that a firm produces,the

Q63: When non-value added time is greater,manufacturing cycle

Q105: In activity-based costing,how are cost drivers selected?

Q126: Activity-based costing and generally accepted accounting principles

Q168: Which of the following add customer value?<br>A)setup