Multiple Choice

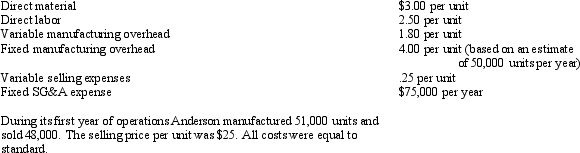

Anderson Corporation Anderson Corporation has the following standard costs associated with the manufacture and sale of one of its products: Refer to Anderson Corporation.Under variable costing,the standard production cost per unit for the current year was

Refer to Anderson Corporation.Under variable costing,the standard production cost per unit for the current year was

A) $11.30.

B) $7.30.

C) $7.55.

D) $11.55.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Another name for variable costing is<br>A)full costing.<br>B)direct

Q48: If underapplied or overapplied factory overhead is

Q63: If overapplied factory overhead is immaterial,the account

Q64: O'Brien Corporation applies overhead at the rate

Q66: Consider the regression equation y = a

Q67: If underapplied overhead is considered to beimmaterial,it

Q70: Austin Company The following information is available

Q73: Absorption costing differs from variable costing in

Q180: Plantwide overhead rates provide a less accurate

Q184: If underapplied factory overhead is material,it is