Multiple Choice

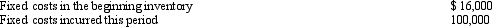

The following information regarding fixed production costs from a manufacturing firm is available for the current year:  Which of the following statements is not true?

Which of the following statements is not true?

A) The maximum amount of fixed production costs that this firm could deduct using absorption costs in the current year is $116,000.

B) The maximum difference between this firm's the current year income based on absorption costing and its income based on variable costing is $16,000.

C) Using variable costing,this firm will deduct no more than $16,000 for fixed production costs.

D) If this firm produced substantially more units than it sold in the current year,variable costing will probably yield a lower income than absorption costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q32: The Internal Revenue Service allows the use

Q57: Absorption costing is commonly used for external

Q83: Which of the following is an argument

Q113: If underapplied or overapplied factory overhead is

Q120: Anderson Corporation Anderson Corporation has the following

Q121: For financial reporting to the IRS and

Q147: Under absorption costing,if sales remain constant from

Q167: The slope of a regression line is

Q170: Overapplied overhead will result if<br>A)the plant is

Q182: Consider the following three product costing alternatives: