Multiple Choice

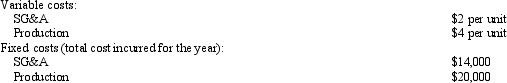

Oakwood Corporation Oakwood Corporation produces a single product.The following cost structure applied to its first year of operations: Refer to Oakwood Corporation.Assume for this question only that Oakwood Corporation produced 5,000 units and sold 4,500 units in the current year.If Oakwood uses absorption costing,it would deduct period costs of

Refer to Oakwood Corporation.Assume for this question only that Oakwood Corporation produced 5,000 units and sold 4,500 units in the current year.If Oakwood uses absorption costing,it would deduct period costs of

A) $24,000.

B) $34,000.

C) $27,000.

D) $23,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Another name for variable costing is<br>A)full costing.<br>B)direct

Q39: The performance measure that considers routine interruptions

Q52: Sheets Corporation The following information was extracted

Q58: On December 30,a fire destroyed most of

Q63: If overapplied factory overhead is immaterial,the account

Q72: A performance measure that is short-run in

Q97: Direct costing conforms with generally accepted accounting

Q105: When using the high-low method,fixed costs are

Q150: The FASB requires which of the following

Q184: If underapplied factory overhead is material,it is