Multiple Choice

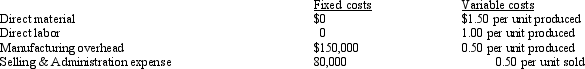

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit.Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year.Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs.Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation.In presenting inventory on the balance sheet at December 31,the unit cost under absorption costing is

A) $2.50.

B) $3.00.

C) $3.50.

D) $4.50.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: If a firm uses variable costing,fixed manufacturing

Q17: The estimated maximum potential activity for a

Q30: Bush Corporation The following information has been

Q34: Discuss underapplied and overapplied overhead and its

Q53: The regression equation y = a+ bX

Q78: Absorption costing is commonly used for internal

Q98: Discuss the application of the high-low method.

Q116: Why should predetermined overhead rates be used?

Q132: The high-low method excludes outliers from the

Q135: If a firm produces more units than