Multiple Choice

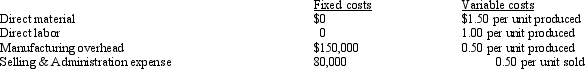

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit.Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year.Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs.Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation.What is the net income under absorption costing?

A) $50,000

B) $80,000

C) $90,000

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following must be known

Q37: When a manufacturing company has a highly

Q100: Practical capacity does not adjust for routine

Q115: If sales exceed production,absorption costing net income

Q140: Sheets Corporation The following information was extracted

Q141: Davis Corporation has the following data relating

Q145: Denver Corporation The records of Denver Corporation

Q146: Wyman Company owns two luxury automobiles that

Q173: Which of the following statements is true

Q183: Which of the following is a term