Essay

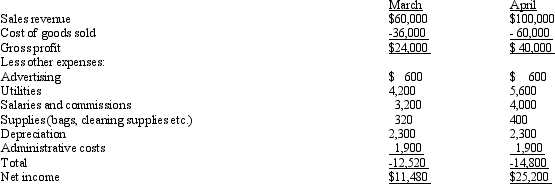

McFatter Office Supply Company has the following information available regarding costs and revenues for two recent months.Selling price is $20.

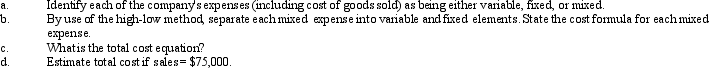

Required:

Required:

Correct Answer:

Verified

FC = $4,200 - (3.5% ´ 60,000...

FC = $4,200 - (3.5% ´ 60,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: In a normal cost system,factory overhead is

Q9: Normal capacity considers present and future production

Q13: The costing system that classifies costs by

Q24: What are three reasons that overhead must

Q50: If actual overhead is less than applied

Q54: In a(n)_ cost system,factory overhead is assigned

Q77: Absorption costing conforms with generally accepted accounting

Q81: If production exceeds sales,absorption costing net income

Q184: Pratt Tailors has gathered information on utility

Q188: Allen Corporation uses a predetermined overhead application