Essay

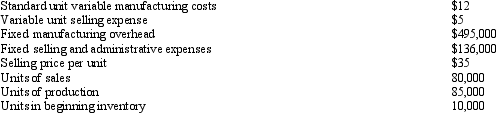

Awesome Athletics,Inc.has developed a new design to produce hurdles that are used in track and field competition.The company's hurdle design is innovative in that the hurdle yields when hit by a runner and its height is extraordinarily easy to adjust.Management estimates expected annual capacity to be 90,000 units; overhead is applied using expected annual capacity.The company's cost accountant predicts the following current year activities and related costs:

Other than any possible under- or overapplied fixed overhead,management expects no variances from the previous manufacturing costs.Under- or overapplied fixed overhead is to be written off to Cost of Goods Sold.

Other than any possible under- or overapplied fixed overhead,management expects no variances from the previous manufacturing costs.Under- or overapplied fixed overhead is to be written off to Cost of Goods Sold.

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q18: What are the primary reasons for using

Q20: Austin Company The following information is available

Q22: Denver Corporation The records of Denver Corporation

Q23: William Shafer Company used least squares regression

Q24: In relationship to changes in activity,fixed overhead

Q47: Under absorption costing,fixed manufacturing overhead could be

Q76: The slope of a regression line is

Q79: Consider the following three product costing alternatives:

Q124: Variable costing is commonly used for external

Q161: A debit to the Factory Overhead account