Multiple Choice

11111

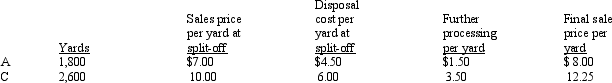

-Johnson Company Ellis Company produces two products from a joint process: A andC Joint processing costs for this production cycle are $9,000.  If A and C are processed further,no disposal costs will be incurred or such costs will be borne by the buyer.

If A and C are processed further,no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Johnson Company.Using a physical measure,what amount of joint processing cost is allocated to Product A (round to the nearest dollar) ?

A) $2,938

B) $3,682

C) $4,500

D) $5,318

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The relative-sales-value method requires a common physical

Q7: Joint costs are allocated to which of

Q8: Sun Glo Company Sun Glo Company produces

Q9: The net realizable value approach requires that

Q10: Sun Glo Company Sun Glo Company produces

Q39: Costs that are incurred after the split-off

Q44: If incremental revenues beyond split-off are less

Q91: Which of the following statements is true

Q117: Joint costs may be allocated to main

Q127: Incremental separate costs are defined as all