Multiple Choice

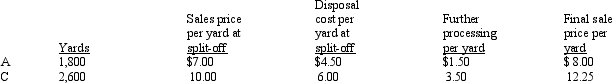

Johnson Company Ellis Company produces two products from a joint process: A and C Joint processing costs for this production cycle are $9,000.  If A and C are processed further,no disposal costs will be incurred or such costs will be borne by the buyer.

If A and C are processed further,no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Johnson Company.Using sales value at split-off,what amount of joint processing cost is allocated to Product C (round to the nearest dollar) ?

A) $2,938

B) $3,682

C) $4,500

D) $6,062

Correct Answer:

Verified

Correct Answer:

Verified

Q17: While preparing a salad,the chef removes the

Q20: The split-off point is the point at

Q38: Costs that are incurred in the manufacture

Q44: Brite Surface Company Brite Surface Company produces

Q46: Davis Company Davis Company produces three products:

Q47: Kelly Company Kelly Company is placing an

Q48: In a lumber mill,which of the following

Q51: Relative sales value at split-off is used

Q119: The net realizable value approach mandates that

Q136: Briefly discuss the four decisions that management