Multiple Choice

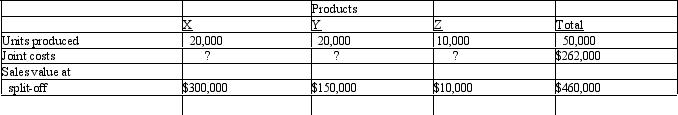

Kellman Company Kellman Company manufactures products X and Y from a joint process that also yields a by-product,Z.Revenue from sales of Z is treated as a reduction of joint costs.Additional information is as follows: Joint costs were allocated using the sales value at split-off approach.

Joint costs were allocated using the sales value at split-off approach.

Refer to Kellman Company.The joint costs allocated to product X were

A) $ 84,000

B) $100,800.

C) $150,000.

D) $168,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The net realizable value approach is used

Q19: Brite Surface Company Brite Surface Company produces

Q21: A decision that must be made at

Q23: Why is the net realizable value of

Q27: Davis Company Davis Company produces three products:

Q65: Joint costs may be allocated to by-products

Q80: Two incidental products of a joint process

Q81: By-products are<br>A)items resulting from a joint process

Q103: Joint costs include all materials,labor and overhead

Q112: Joint costs occur before the split-off point