Essay

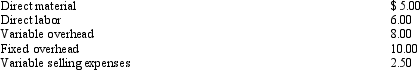

Phoenix Corporation makes and sells the "Desert Icon",a wall hanging depicting a magical cactus plant.The Desert Icons are sold at specialty shops for $50 each.The capacity of the plant is 15,000 Icons.Costs to manufacture and sell each wall hanging are as follows:

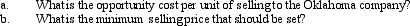

Phoenix Corporation has been approached by a Oklahoma company about purchasing 2,500 Desert Icons.The company is currently making and selling 15,000 per year.The Oklahoma company wants to attach its own state label,which increases costs by $.50 each.No selling expenses would be incurred on this order.The corporation believes that it must make an additional $1 on each Desert Icon to accept this offer.

Phoenix Corporation has been approached by a Oklahoma company about purchasing 2,500 Desert Icons.The company is currently making and selling 15,000 per year.The Oklahoma company wants to attach its own state label,which increases costs by $.50 each.No selling expenses would be incurred on this order.The corporation believes that it must make an additional $1 on each Desert Icon to accept this offer.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The graphical approach to solving a linear

Q15: Lawson Company produces a part that has

Q20: Waldrup Corporation Waldrup Corporation sells a product

Q21: Irrelevant costs generally include <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4447/.jpg" alt="Irrelevant

Q22: Atlanta Motors Atlanta Motors is trying to

Q23: Why is depreciation expense irrelevant to most

Q70: In a make or buy decision,the opportunity

Q94: Which of the following activities within an

Q101: In a make or buy decision,the reliability

Q110: In evaluating the profitability of a specific