Essay

On January 1, 2014, the accounts of Mac Corporation showed the following: During 2014, the following transactions occurred which affected stockholders' equity (in the order given): A. Issued a stock dividend when the market price was at per share.

B. Purchased treasury stock, 1,000 shares, at a total cost of .

C. Declared and paid cash dividends, .

D. Net income for . Required:

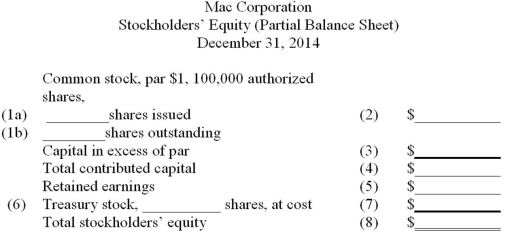

The stockholders' equity section of the balance sheet for the company must be prepared for the December 31, 2014 balance sheet. The format is given below with certain amounts missing. Supply the missing amounts by entering them in the blanks.

Correct Answer:

Verified

(1a) Capital in excess of par = $60,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: There would be 100,000 shares of common

Q65: Which of the following represents the number

Q84: Which of the following statements is not

Q90: Which of the following is true about

Q91: Which of the following statements is correct?<br>A)

Q92: Assume the following capital structure: Preferred stock,

Q97: Cornhusker Corporation plans to raise $10 million

Q98: Which of the following journal entries

Q115: When a company acquires treasury stock,assets and

Q134: When a company pays its previously declared