Multiple Choice

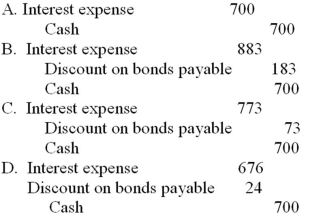

On January 1, 2014, Tonika Corporation issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Assuming the effective-interest amortization is used, and rounding calculations to the nearest whole dollar, which of the following journal entries correctly records the 2014 interest expense?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q14: The debt-to-equity ratio is calculated by dividing

Q17: Which of the following statements is correct?<br>A)A

Q57: Houston Company authorized a $1,000,000, 10-year, 6%

Q59: On March 31, 2014, Bundy Corporation retired

Q60: On July 1, 2014, Garden Works, Inc.

Q61: A company prepared the following journal entry:

Q64: A bond issued at a premium will

Q66: Straight-line amortization of a premium related to

Q67: On July 1, 2015, immediately after recording

Q80: The cash payment for interest on a