Multiple Choice

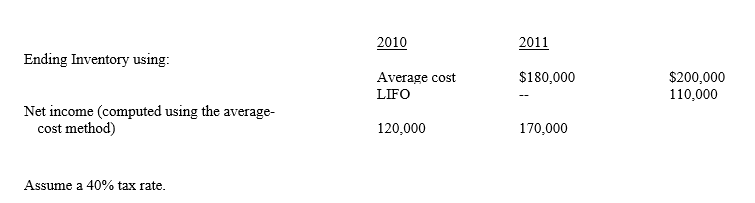

Wilma Company began operations in 2010 and uses the average cost method in costing its inventory.In 2011, Wilma is investigating a change to the LIFO method.Before making that determination, Wilma desires to determine what effect such a change will have on net income.Wilma has compiled the following information:  Assume a 40% tax rate.

Assume a 40% tax rate.

If Wilma adopted LIFO in 2011, net income would be

A) $ 80, 000

B) $116, 000

C) $170, 000

D) $224, 000

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Mary Company purchased equipment on January 1,

Q27: When applying retrospective adjustments, current GAAP requires

Q28: Exhibit 23-5 Nan Company, having a

Q29: The Zack Company began its operations

Q30: Disclosure of a retrospective adjustment should include<br>A)why

Q32: On January 1, 2010, Teresa loaned

Q33: Which of the following accounting changes is

Q34: An item that would not be accounted

Q35: Several errors are listed below.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5176/.jpg"

Q36: Which of the following errors normally would