Multiple Choice

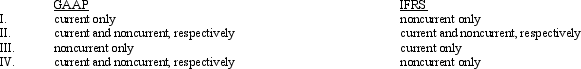

The acceptable balance sheet classifications for deferred tax assets and deferred tax liabilities under GAAP and IFRS are

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q48: Differences between pretax financial income and taxable

Q49: The Clear Lake Corporation reported the following

Q50: Which one of the following would require

Q51: All of the following involve a temporary

Q52: Life insurance proceeds payable to a corporation

Q54: Interperiod income tax allocation is based on

Q55: In 2010, its first year of

Q56: All of the following involve a temporary

Q57: Boerne Company received rent in advance of

Q58: In 2010, its first year of operations,