Essay

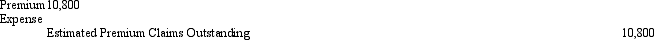

Ingram, Inc., places a coupon in each box of its product.Customers may send in ten coupons and $3, and the company will send them a CD.Sufficient CDs were purchased at $5 apiece.A certain number of boxes of product were sold in 2010.It was estimated that a total of 5% of the coupons will be redeemed.In 2010, 18, 000 coupons were redeemed.Mailing costs were $0.40 per CD.At December 31, 2010, the following adjusting entry was made to record the estimated liability for premium outstanding:

Required:

Required:

Compute the number of boxes of product sold by Ingram in 2010.

Correct Answer:

Verified

None...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Which of the following statements is true?<br>A)GAAP

Q42: Unearned or deferred revenue can occur when<br>A)services

Q43: IFRS accounting for contingencies differs from U.S.GAAP

Q44: Use "yes," "no," or "optional" to indicate

Q45: Bonita places a coupon in each

Q47: Exhibit 13-4 During 2010, the Alexandra Company

Q48: List and describe the three conditions which

Q49: Current liabilities are obligations whose liquidation is

Q50: Which of the following statements regarding the

Q51: Management of current liabilities arises, in part,