Multiple Choice

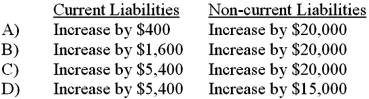

At the beginning of the quarter,your company borrows $20,000 by signing a four-year promissory note that states an annual interest rate of 8% plus principal repayments of $5,000 each year.Interest is paid at the end of the second and fourth quarters,whereas principal payments are due at the end of each year.How does this new promissory note affect the current and non-current liability amounts reported on the balance sheet at the end of the first quarter?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q111: A company issues a 5-year bond with

Q113: The following data came from the financial

Q114: Which of the following would not be

Q115: When interest expense is calculated using the

Q117: A company issued $100,000 5-year,7% bonds and

Q119: The three key pieces of information that

Q120: When a company encounters a contingent liability

Q218: Your company sells $50,000 of bonds for

Q230: The entry to record a bond retirement

Q236: An entertainment company received $6 million in