Essay

Part I

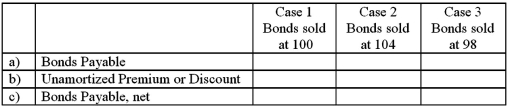

FWP Co.issued $100,000,10-year bonds on January 1,2013.The stated rate of interest on the bonds is 10% payable annually on 12/31.Provide the requested information for the bonds immediately after issuance (January 1,2013)under each of the three independent scenarios described below:  Part II

Part II

On January 1,2014,FWP sells $2 million of 8% bonds at face value with interest to be paid at the end of each year.Prepare the journal entries on the following dates:

a)January 1,2014 (the initial bond sale).

b)March 31,2014 (the end of the first quarter).

c)December 31,2014 (the payment of interest at the end of the year;assume that the interest owed for each of the first three quarters has been properly accrued).

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Some bonds allow the borrower to repay

Q19: Which of the following would help a

Q22: A company receives $95 for merchandise sold

Q27: Which of the following is not true

Q28: A discount on bonds payable is reported

Q126: Using straight-line amortization,when a bond is sold

Q136: Some bonds allow the issuing company to

Q143: Bonds allow a company to borrow large

Q200: A negative times interest earned ratio suggests

Q221: FICA payments consist of Social Security taxes