Multiple Choice

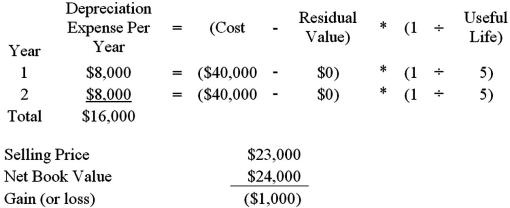

On January 1,2014,Horton Inc.sells a machine for $23,000.The machine was originally purchased on January 1,2012 for $40,000.The machine was estimated to have a useful life of 5 years and a salvage value of $0.Horton uses straight-line depreciation.In recording this transaction:

A) a loss of $1,000 would be recorded.

B) a gain of $1,000 would be recorded.

C) a loss of $17,000 would be recorded.

D) a gain of $23,000 would be recordeD.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: If net sales revenue <span

Q111: On September 1,a company purchased a vehicle

Q134: E.Flynn Company purchased a building for $400,000.The

Q135: A company sells a long-lived asset that

Q136: One difference between the double-declining-balance method and

Q137: Ordinary repairs and maintenance:<br>A)are part of the

Q139: A machine is purchased on January 1,2014,for

Q142: When a company records depreciation it debits:<br>A)liabilities

Q143: T.Powers Company's financial statements on December 31,2013,showed

Q165: Goodwill:<br>A)is not amortized,but is tested annually for