Essay

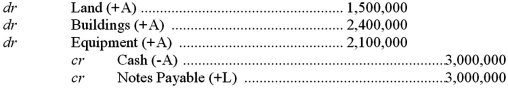

A company purchases property that includes land,buildings and equipment for $5.5 million.The company pays $180,000 in legal fees,$220,000 in commissions,and $100,000 in appraisal fees.The land is estimated at 25%,the buildings are at 40%,and the equipment at 35% of the property value.Prepare the journal entry that is required to record the purchase assuming that the company paid 50% of the amounts using cash and signed a note for the remainder.

Correct Answer:

Verified

Acquisition cost = $5,500,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Use the information above to answer the

Q40: A loss on disposal of an asset

Q74: Which of the following statements most appropriately

Q116: The Buddy Burger Corporation has $3.5 million

Q117: The straight-line depreciation method and the double-declining-balance

Q119: On January 1,2016,Horton Inc.sells a machine for

Q121: If the double-declining balance method were used

Q122: Which of the following statements is true?<br>A)Depreciation

Q123: A company buys a piece of equipment

Q176: The allocation method used for natural resources