Essay

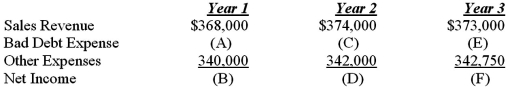

The Dubious Company operates in an industry where all sales are made on account.Historically,Dubious has experienced a steady 1.0% of credit sales being uncollectible.Presented below is the company's forecast of sales and expenses over the next three years.  Using this information:

Using this information:

a.Calculate bad debt expense and net income for each of the three years,assuming uncollectible accounts are estimated as 1.0% of sales.

b.Describe the trend in net income changes from Year 1 to Year 2 and from Year 2 to Year 3.

c.Suppose the company changes its estimate of uncollectible credit sales to 1.0% in Year 1,2.0% in Year 2 and 1.5% in Year 3.Calculate the bad debt expense and net income for each of the three years under this alternative scenario.

d.Describe the trend in net income changes determined in requirement c from Year 1 to Year 2 and Year 2 to Year 3.

e.Explain some of the factors that might cause the estimate of uncollectible accounts to vary from year to year as in part c above.

Correct Answer:

Verified

a.  b.Net income increases between years...

b.Net income increases between years...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q107: On the balance sheet,the allowance for doubtful

Q133: When an adjusting entry is made in

Q134: Your company previously averaged about 20% of

Q135: The allowance method for uncollectible accounts is

Q136: Net accounts receivable is:<br>A)gross accounts receivable minus

Q137: Which of the following statements regarding the

Q139: Interest on a two-month,7%,$1,000 note would be

Q140: When a company makes an adjustment in

Q142: Indicate whether each of the following items

Q143: The direct write-off method for uncollectible accounts