Essay

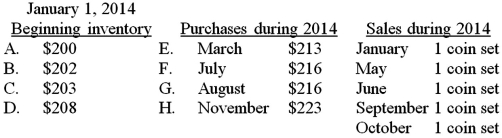

The following company buys and sells identical collectors' coin sets.The company uses LIFO.In the first two columns below,each coin set is identified by its letter and its cost.The third column indicates when coin sets were sold.

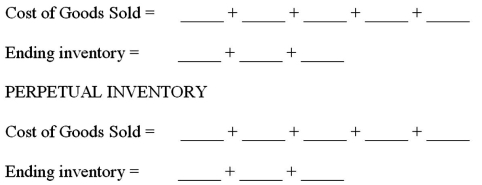

For each inventory costing method given below,fill in the blanks to indicate the letter of the coin set which will be used to calculate either cost of goods sold or the cost of ending inventory.  PERIODIC INVENTORY: Inventory is taken on December 31,2014.

PERIODIC INVENTORY: Inventory is taken on December 31,2014.  This example shows the cost of the coin sets increasing over time.Using the symbols ">" (greater than)," = " (equals),or "<" (less than),complete the following comparisons by filling in the blanks in the statements below.

This example shows the cost of the coin sets increasing over time.Using the symbols ">" (greater than)," = " (equals),or "<" (less than),complete the following comparisons by filling in the blanks in the statements below.

Using LIFO with increasing costs,cost of goods sold under periodic inventory _____ cost of goods sold under perpetual inventory.

Using LIFO with increasing costs,ending inventory under periodic inventory _____ ending inventory under perpetual inventory.

Using LIFO with increasing costs,net income under periodic inventory _____ net income under perpetual inventory.

Correct Answer:

Verified

PERIODIC INVENTORY: Inventory is taken o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q129: What is the amount of the discount

Q130: An increasing balance in the inventory account

Q131: Which of the following effects would occur

Q132: Inaccurately counted inventory levels reduce a company's

Q133: Manufacturers have three types of inventory: raw

Q135: Which of the following statements is true?<br>A)When

Q136: Use the information above to answer the

Q137: Which of the following would be in

Q138: If inventory is sold with terms of

Q139: Use the information above to answer the