Multiple Choice

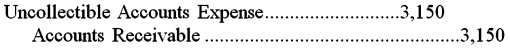

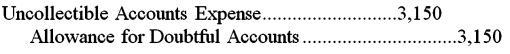

A firm reported sales of $300,000 during the year.Prior to adjustment,Allowance for Doubtful Accounts has a debit balance of $100.Based on an aging of accounts receivable,the firm estimated its losses from uncollectible accounts to be $3,150.The entry to record the estimated bad debt losses will be:

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Which of the following statements is not

Q3: Allowance for Doubtful Accounts has a credit

Q4: A firm reported sales of $500,000 during

Q6: Allowance for Doubtful Accounts has a credit

Q8: On December 31,prior to adjustments,the balance of

Q9: When the allowance method of recognizing losses

Q10: Under the Allowance Method of accounting for

Q11: A firm using the allowance method to

Q17: When using the allowance method, the collection

Q79: The experience of other firms in the