Essay

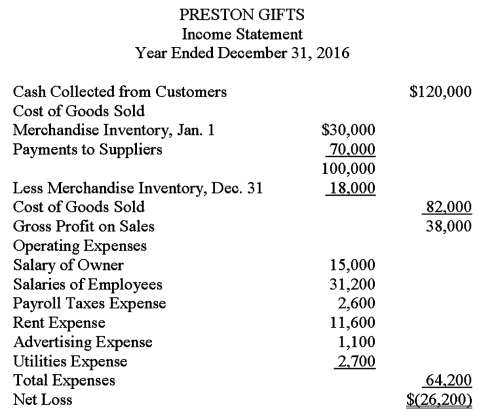

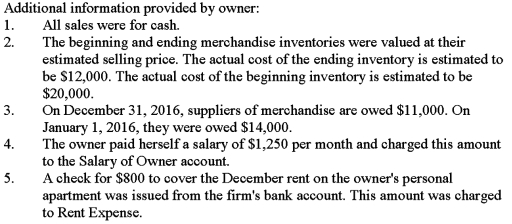

The income statement shown below was prepared and sent by Jenna Preston,the owner of Preston Gifts,to several of her creditors.The business is a sole proprietorship that sells miscellaneous gifts.An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles.Using the following additional information provided by the owner,prepare an income statement in accordance with generally accepted accounting principles.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The matching principle requires that all known

Q37: The Statements of Financial Accounting Standards that

Q39: The monetary unit assumption assumes that:<br>A) the

Q40: The Financial Accounting Standards Board is<br>A) a

Q42: Carlos Verde owns a small nursery.He recently

Q43: In order to ensure that they are

Q49: What is meant by the concept of

Q71: The _ principle requires that if income

Q83: The concept of realization permits a company

Q95: If too much of the cost of