Essay

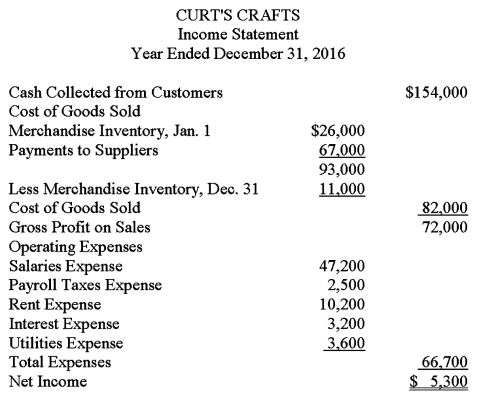

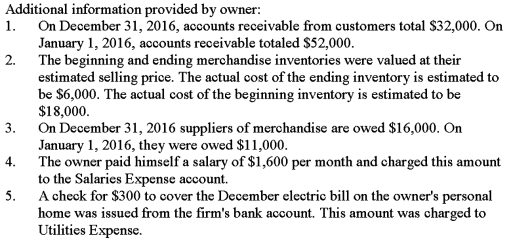

The income statement shown below was prepared and sent by Curtis Brown,the owner of Curt's Crafts,to several of his creditors.The business is a sole proprietorship that sells crafts and toys.An accountant for one of the creditors looked over the income statement and found that it did not conform to generally accepted accounting principles.Using the following additional information provided by the owner,prepare an income statement in accordance with generally accepted accounting principles.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Antonio Hanley owns a small automobile service

Q20: An accountant charged the Repairs Expense account

Q22: The basic financial reports of a business

Q23: Assets are carried on the books at

Q25: The SEC's 2003 report to the Congress

Q26: Identify the statement below that is incorrect.<br>A)

Q27: Which of the following statements is not

Q28: The separate economic entity assumption assumes that:<br>A)

Q29: An accountant who records revenue when a

Q80: Because financial statements must be objective and