Multiple Choice

During the week ended June 15,Wiley Automotive's employees earned $2,000 of gross wages and had $300 of federal income tax withheld.All of their employees had already earned over $7,000 of gross wages for the year so none of their wages were subject to FUTA or SUTA tax.However,all of their wages were still subject to Social Security tax of 6.2% and Medicare tax of 1.45%.The journal entry to record Payroll Tax Expense for the pay period would be:

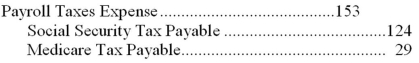

A)

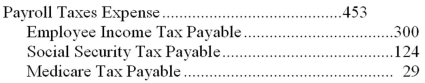

B)

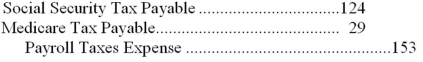

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Most states require that the employer file

Q14: The premium rate on workers' compensation insurance

Q15: After the ABC Corporation paid its employees

Q16: To record the deposit of FUTA tax,the

Q19: After the JPR Corporation paid its employees

Q20: Wharfside Manufacturing estimates that its office employees

Q21: After the Marion Corporation paid its employees

Q22: Both the employer and the employee are

Q25: Which of the following payroll taxes is

Q37: Form 940 is used to report _