Multiple Choice

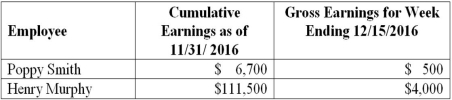

ABC Consulting had two employees with the following earnings information:  Use the table above and calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

Use the table above and calculate the employer payroll income taxes associated with Poppy's December 15 paycheck given the following tax rates: Social Security tax of 6.2% is levied on the first $113,700 of annual wages and the Medicare tax rate is 1.45% on all earnings.State unemployment tax of 5.4% and federal unemployment tax of .6% are both levied on only the first $7,000 of each employee's annual earnings.

A) $622.65

B) $68.25

C) $56.25

D) $23.45

Correct Answer:

Verified

Correct Answer:

Verified

Q46: All of the following taxes are withheld

Q47: The payroll register of Reynolds Company showed

Q48: The payroll register of the Retro Manufacturing

Q49: Rick O'Shea,the only employee of Hunter Furniture

Q50: Samantha Rodriguez had gross earnings for the

Q53: Compute and record workers' compensation insurance premiums

Q55: Which of the following statements is correct?<br>A)

Q56: Only the employer is responsible for paying<br>A)

Q57: A business pays the social security tax

Q86: The entry to record the deposit of