Essay

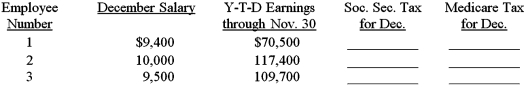

The monthly salaries for December and the year-to-date earnings as of November 30 for the three employees of the Design Warehouse are listed below.Compute the amount of social security tax and Medicare tax to be withheld from each of the employee's gross pay for December.Assume a 6.2 percent social security tax rate and a base of $113,700 for the calendar year.Assume a 1.45 percent Medicare tax rate.

Correct Answer:

Verified

Employee No.1: Soc.Sec.Tax,$58...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Employees submit Form W-4 to their employers

Q55: The maximum base for the social security

Q69: Identify the list of accounts below that

Q70: It is best not to pay wages

Q71: If an employee whose regular hourly rate

Q74: The employer records the amount of federal

Q75: An independent _ is paid by the

Q76: During one week,three employees of the Pampered

Q78: An employee whose regular hourly rate is

Q79: During one week,three employees of the Siesta