Essay

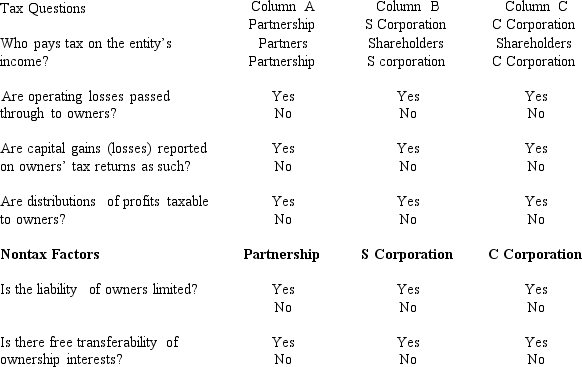

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The correc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q1: During the current year, Gray Corporation, a

Q6: The passive loss rules apply to closely

Q16: Jake,the sole shareholder of Peach Corporation,a C

Q41: Don, the sole shareholder of Pastel Corporation

Q53: Ostrich, a C corporation, has a

Q59: Ivory Corporation, a calendar year, accrual method

Q82: Lucinda is a 60% shareholder in Rhea

Q107: In the current year,Crimson,Inc.,a calendar C corporation,has

Q108: Income that is included in net income

Q116: Because of the taxable income limitation, no