Short Answer

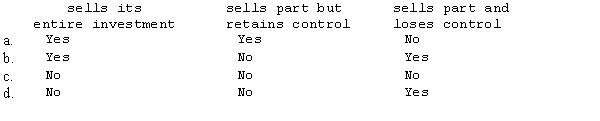

When a parent sells its subsidiary interest, a gain (loss) is recognized if the parent

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: A new subsidiary is being formed.The parent

Q6: Page & Seed scenario:<br>Page Company purchased an

Q7: Pine & Scent scenario:<br>Pine Company purchased a

Q10: Company P has consistently sold merchandise for

Q12: On January 1, 20X1, Company P purchased

Q15: In the year a parent sells its

Q16: Pine & Scent scenario:<br>Pine Company purchased a

Q25: Company P owns an 90% interest in

Q30: Saddle Corporation is an 80%-owned subsidiary of

Q35: Which of the following statements is incorrect