Essay

Company P Industries purchased a 70% interest in Company S on January 1, 20X1, and prepared the following determination and distribution of excess schedule:

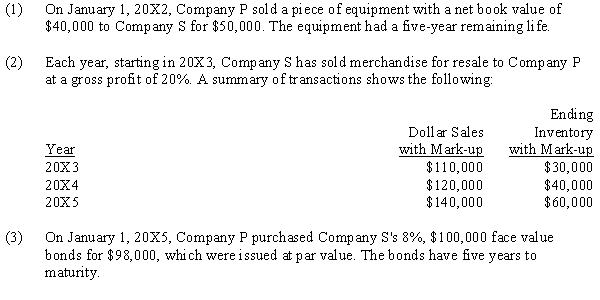

Since the purchase, there have been the following intercompany transactions:

Since the purchase, there have been the following intercompany transactions:

Required:

Required:

Complete the following schedule to adjust the retained earnings of the noncontrolling and controlling interest on the December 31, 20X5, worksheet for a consolidated balance sheet only. Company P uses the simple equity method to account for its investment.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Plant company owns 80% of the common

Q23: On January 1, 20X1, Parent Company acquired

Q25: On January 1, 20X1, Pepper Company

Q25: A parent company owns a 90% interest

Q26: Patten and Salty scenario:<br>Patten Company purchased an

Q28: Patrick & Solomon scenario:<br>On January 1, 20X1,

Q29: Partridge & Sparrow scenario:<br>Partridge purchased a 60%

Q30: Pine & Scent scenario:<br>Pine Company purchased a

Q32: Patrick & Solomon scenario:<br>On January 1, 20X1,

Q38: A new subsidiary is being formed.The parent