Essay

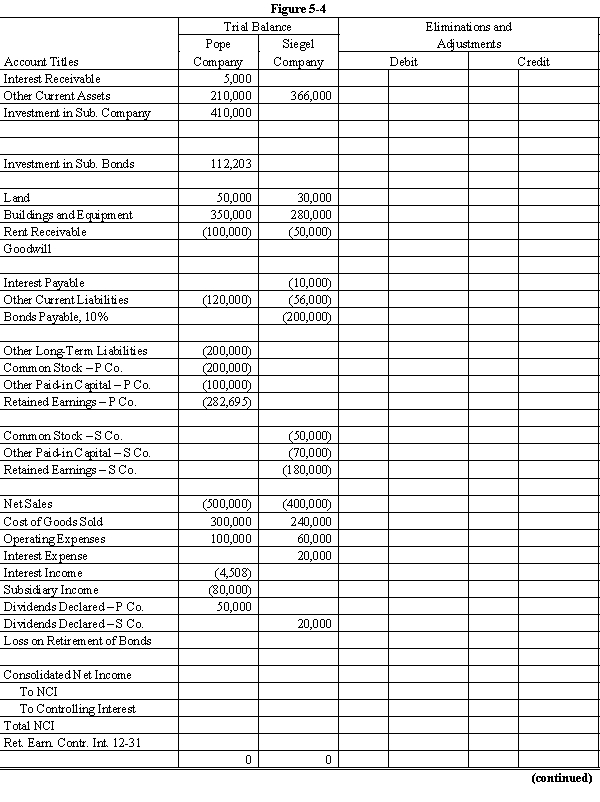

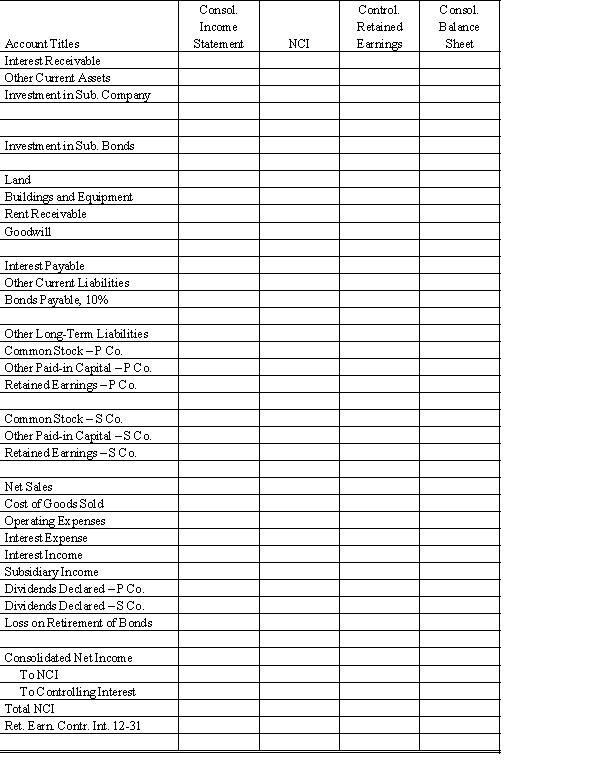

On January 1, 20X8, Pope Company acquired 100% of the common stock of Siegel Company for $300,000. On this date Siegel had total owners' equity of $250,000. Any excess of cost over book value is attributable to goodwill. Pope accounts for its investment in Siegel using the simple equity method.

Also on July 1, 20X8, Siegel Company sold to outside investors $200,000 par value of 10-year, 10% bonds. The price received was equal to par. The bonds pay interest semi-annually on July 1 and January 1.

During early 20X9, market interest rates on bonds similar to those issued by Siegel decreased to 8%. As a result, the market value of the bonds increased. On July 1, 20X9, Pope purchased $100,000 par value of Siegel's bonds, paying $112,695. Pope still holds the bonds on December 31, 20X9 and has amortized the premium, using the effective-interest method.

Required:

Complete the Figure 5-4 worksheet for consolidated financial statements for the year ended December 31, 20X9. Round all computations to the nearest dollar.

Correct Answer:

Verified

For the worksheet solution, please refer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Park owns an 80% interest in the

Q14: On January 1, 20X1 Parent Company acquired

Q17: Consolidation procedures for Sale-Type Leases:<br>A) allow for

Q18: On January 1, 20X8, Parent Company purchased

Q21: Which of the following statements is true?<br>A)

Q23: On January 1, 20X1, Parent Company acquired

Q30: Company S is a 100%-owned subsidiary of

Q43: Leasing subsidiaries are formed to achieve centralized

Q47: Company S is a 100%-owned subsidiary of

Q48: Company S is a 100%-owned subsidiary of