Essay

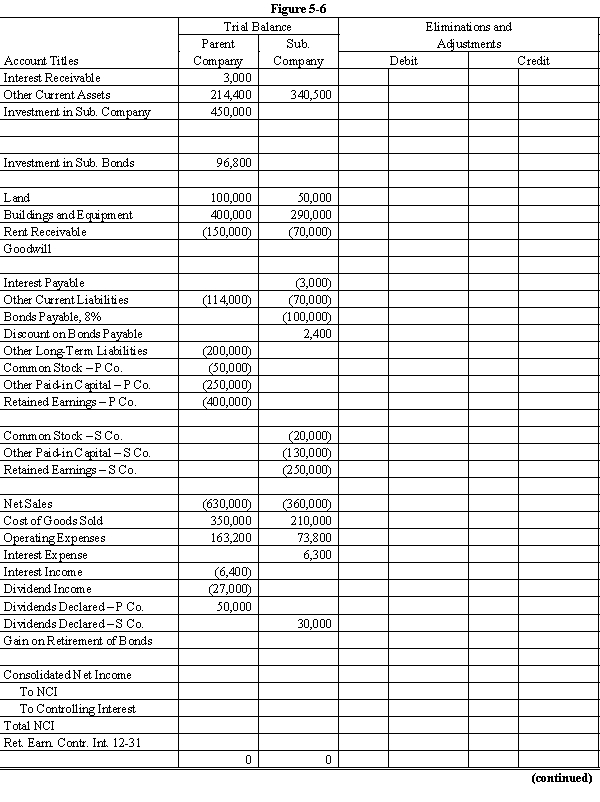

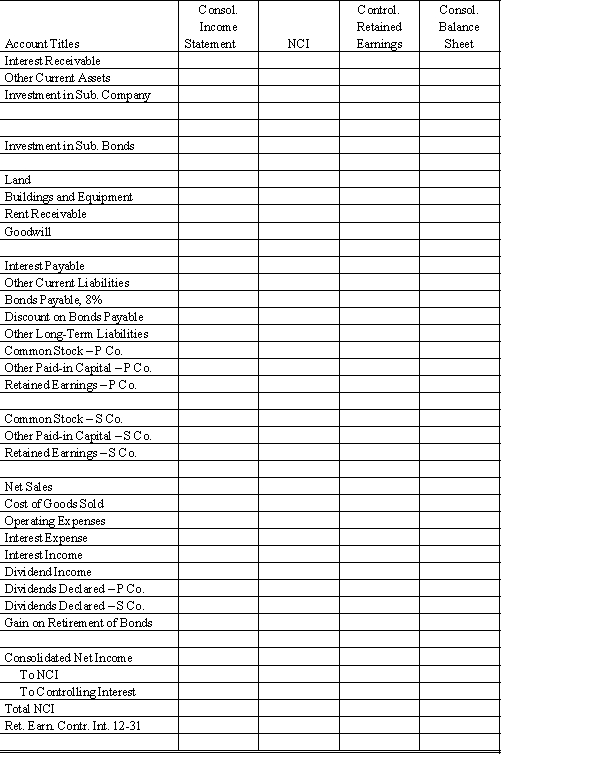

On January 1, 20X8, Parent Company purchased 90% of the common stock of Subsidiary Company for $450,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $20,000, $130,000, and $200,000, respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the cost method.

On January 1, 20X8, Subsidiary sold $100,000 par value of 6%, ten-year bonds for $97,000. The bonds pay interest semi-annually on January 1 and July 1 of each year.

On January 1, 20X9, Parent repurchased all of Subsidiary's bonds for $96,400. The bonds are still held on December 31, 20X9.

Both companies have correctly recorded all entries relative to bonds and interest, using straight-line amortization for premium or discount.

Required:

Complete the Figure 5-6 worksheet for consolidated financial statements for the year ended of December 31, 20X9. Round all computations to the nearest dollar.

Correct Answer:

Verified

For the worksheet solution, please refer...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Intercompany debt that must be eliminated from

Q6: In the year when one member of

Q28: On an income distribution schedule, any gain

Q33: Sun Company is a 100%-owned subsidiary of

Q40: A subsidiary has outstanding $100,000 of 8%

Q44: Which of the following statements is true?<br>A)

Q46: Soap & Pumice: Soap Company issued $200,000

Q47: In years subsequent to the year one

Q49: Company S is a 100%-owned subsidiary of

Q52: On January 1, 20X8, Parent Company purchased