Essay

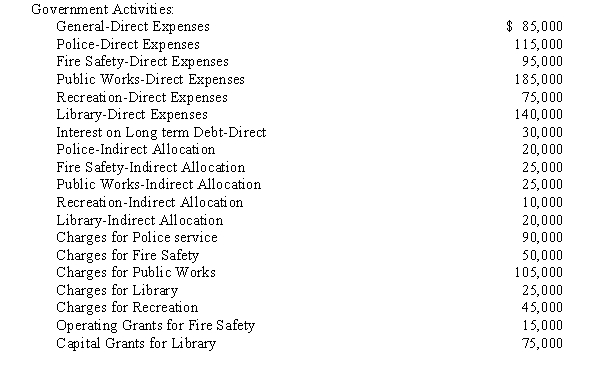

The City of Terrytown reports the following information:

There are no business type activities for this city or other component units. Taxes raised for general revenues equal $200,000 and taxes raised for debt service equal $25,000. Other general revenues were generated through fines, fees, and permits that total $100,000. The city also sold a plot of land for a gain of $10,000. The beginning of the year net assets totaled $155,000.

There are no business type activities for this city or other component units. Taxes raised for general revenues equal $200,000 and taxes raised for debt service equal $25,000. Other general revenues were generated through fines, fees, and permits that total $100,000. The city also sold a plot of land for a gain of $10,000. The beginning of the year net assets totaled $155,000.

Required:

Prepare a statement of activities schedule for the city.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: GASB Statement No. 34 requires a separate

Q7: In the Comprehensive Annual Financial Report (CAFR)

Q8: A quasi-external transaction such as the sale

Q9: The Single Audit Act requires that a

Q10: In order to convert the governmental fund

Q14: Converting the governmental fund balance sheet to

Q14: Which of the following combination of reports

Q15: From the following information, prepare a statement

Q31: Reciprocal interfund activities include all but which

Q36: The most common difference between funds-based and