Essay

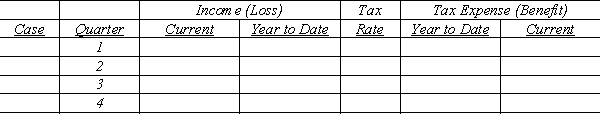

Consider the following:

Case A

Income (loss) for quarters 1 through 4 is ($50,000), $30,000, $40,000, and $40,000, respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be $20,000. No carryback benefit exists, and any future annual benefit is uncertain.

Case B

Assume the same facts as in Case A. However, at the end of quarters 1 through 3, annual income is estimated to be $40,000.

Case C

Quarterly income (loss) levels were $15,000, ($35,000), ($75,000), and $25,000. A yearly operating loss of $70,000 was anticipated throughout the year. Prior years' income of $28,000 is available for carryback. The same tax rates were relevant to the carryback period

Required:

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The management approach to segmental reporting<br>A)focuses on

Q10: Lancaster Inc. expects to have taxable

Q11: Which of the following is NOT considered

Q12: Futura Corporation reported pretax net income of

Q15: Scenario 12-1<br>Ansfield, Inc. has several potentially

Q16: Which of the following statements about interim

Q18: In order to generate interim financial reports

Q18: Non-ordinary items resulting in income or loss<br>A)include

Q49: Corriveau Industries decided to switch from an

Q57: Which of the following best describes how