Multiple Choice

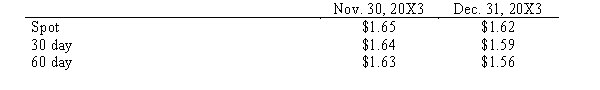

Hugh, Inc. purchased merchandise for 300,000 FC from a British vendor on November 30, 20X3. Payment in British pounds is due January 31, 20X4. Exchange rates to purchase 1 FC is as follows:  In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

In the December 31, 20X3 income statement, what amount should Hugh report as foreign exchange gain from this transaction?

A) $12,000

B) $9,000

C) $6,000

D) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q11: On September 15, 20X2, Wall Company, a

Q12: Current disclosure requires users of hedging instruments

Q14: Pile, Inc. purchased merchandise for 500,000 FC

Q15: Describe the disclosures required by the FASB

Q17: On November 1, 20X1, a U.S. company

Q19: Scenario 10-2<br>On 4/1/X3, a U.S. Company commits

Q21: Explain how the risks differ for holders

Q33: A U.S.company that has purchased inventory from

Q39: Which of the following does not represent

Q47: The time value of an option is