Multiple Choice

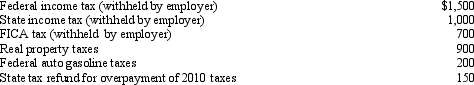

During 2011,Geraldine,a salaried taxpayer,paid the following taxes which were not incurred in connection with a trade or business:  What amount can Geraldine claim for 2011 as an itemized deduction for the taxes paid,assuming she elects to deduct state and local taxes?

What amount can Geraldine claim for 2011 as an itemized deduction for the taxes paid,assuming she elects to deduct state and local taxes?

A) $4,150

B) $1,950

C) $1,000

D) $1,750

E) $1,900

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Which is not true about the higher

Q5: Which of the following expenses would not

Q6: During the current year,Carl and Jill incurred

Q7: Which of the following is not a

Q8: Which of the following expenses are deductible

Q10: Hortense had adjusted gross income in 2011

Q11: Janet and Andrew paid the following amounts

Q13: Which of the following is not deductible

Q13: Which of the following is not deductible

Q14: Which of the following miscellaneous itemized deductions